Parts of VC are somewhat scientific, others are almost an art. Sourcing startups, the process of finding fabulous founders to invest in, falls into the later category. It’s important to share how DRF approaches sourcing, so student founders understand how we learn about them – and engage with us on their terms!

Inbound: Cold Outreach

Inbound sourcing is simple; it’s just responding to applications and cold emails from startups we’ve never seen before.

When founders submit applications, the contents go to the requested regional team. During the academic year, teams review inbound opportunities weekly; a partner is assigned to follow up and schedule a coffee chat, verify eligibility, or pass.

Ready to apply? Submit an application here!

Outbound

Outbound sourcing describes all the ways our partners search for startups to invest in. I’ve seen two really great places to find startups since joining DRF, but this is not exhaustive.

Partner & Founder Networks

One of the most effective ways we find opportunities is by telling our friends about DRF. It’s amazing to see colleagues from the classroom in our pipeline. We want to emphasize that this group doesn’t get special treatment because they are or know our friends. We’ve just noticed that because they know us, they’re more likely to apply.

We also appreciate referrals from founders, including those in our portfolio. This may be the best possible introduction.

We recently invested in Realblock Exchange out of the University of Notre Dame; their founding team already knew Tony from the NYC & Midwest team!

Note: This drives DRF’s preference for having partners at many universities, and partners who are active in their school’s entrepreneurial communities, during recruiting.

Campus Communities

We’ve also had some great successes finding founders through various communities on campus. (Keep a lookout for DRF’s entrepreneurial ecosystems guide dropping soon!) If you’re on a campus with a DRF partner and interested in finding them, we recommend hanging out here.

Entrepreneurship clubs are a fantastic place to start. Different schools have different structures, but most universities these days have a student organization for startups. DRF partners are regularly involved with these communities.

Classes are also really awesome ways we engage with the founder community. Sometimes they’re about startups or tech, but not always. Our role at DRF is to invest in our classmates building awesome things, and we mean that quite literally.

The last big avenue on campus is competitions. Our team enjoys going to pitch competitions to see what student founders are up to; they’re a great way for founders to start building a brand, and maybe even win some investment!

A recent investment we sourced this way is Concentro, who’s founders from HBS were classmates with our partner Daniel!

Cold Outreach

Cold emails aren’t just for founders! We’ve recently teamed up with Harmonic.ai, and will be using their database to search for founders in our investing universe. This partnership was announced only a couple months ago, so we haven’t completed any investments that started this way yet.

Someday soon, we might pitch you on pitching to us…

What DRF looks for

In short, we’re looking for everything we want to see in an investment we’d choose to make – or their leading indicators.

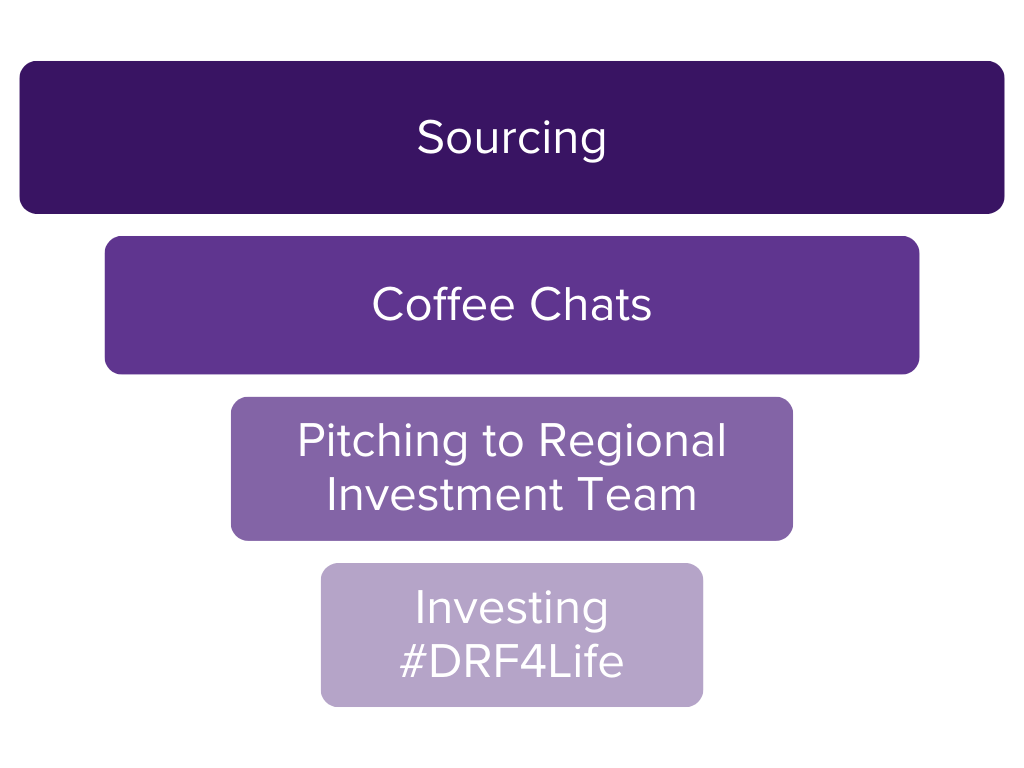

We think of interactions with founders as funnel-shaped. We source many startups, and can invest in only a few. Our goal at each stage is to qualify (in a sales sense) a startup for the next step.

Here’s what we’re looking for at the top of the funnel:

- Awesome founders are essential!

- We prefer to invest in teams.

- A vision for an amazing product is not negotiable.

- We prefer visions that a team member has a unique connection to.

- We strongly prefer products with meaningful moats.

- Potential for venture scale returns on an investment is a deal-breaker.

To the extent that founders know about DRF’s terms, we also need to see alignment on that. Our standard investment is a $40,000 SAFE for 1.33% of a startup. This implies a post-money valuation of approximately $3,000,000. VC has a high cost of capital, and is not suitable for every startup.

A final note

Since winter quarter started, I’ve had multiple friends tell me about their startup idea in passing, and finish with “but I didn’t want to say anything until everything was packaged and ready for a prospective investor to look at.”

Please, please, please do not do this with us at DRF. No idea is too early to come and talk about with us!

We’re happy to provide feedback and advice from our perspective as student investors, and we want to be as helpful to you as we possibly can. No idea is too early to discuss.

If you see a DRF partner on campus, and want to grab coffee and knock around a product idea, or get some GTM feedback – don’t be a stranger!

Written by DRF partner Aaron Pickard.

For more updates, follow us on our Twitter, Medium, and newsletter. Founders, apply for an investment from us. 🚀