What is venture capital?

Venture capital (VC) is a form of private equity that sees returns in five to 10 years, unlike public assets, which expect rewards earlier. In venture capital, investors expect high risk with high rewards.

Venture capitalists buy a share of a company known as a startup, which can’t raise traditional finance through bank loans or capital markets. These startups face high uncertainty with high rates of failure, but venture capitalists see high growth potential and bet that if they invest early, they will win big.

Who’s who in VC?

General partners or managing directors: Most senior members who make final investment decisions and can sit on the board of directors of portfolio companies.

Principals: Junior deal professionals who don’t make the final call in investments but help with recruiting, operations, technology, and sales.

Associates: They source deals, do due diligence on existing deals, and write memos about potential investments. Since they’re non-deal partners, they work with one or more deal partners.

Analysts: College graduates. Similar role to associates but at the bottom of the ladder.

Venture partners and Entrepreneurs in Residence: Part-time members who help manage investments or introduce firms to new ones.

VC fund structure

The management company, which oversees the general partners, pays the salaries and expenses from a 2% management fee – an industry standard across VC firms.

General partners contribute 1-2% of the total fund size to the legal entity and receive the carry from the fund, defined as the compensation partners receive if they exceed a threshold return.

The limited partners (LPs) commit 98% of the fund’s capital and receive their money back before general partners. The rest of the profits are distributed 80% to limited partners and 20% to general partners.

How VCs make money

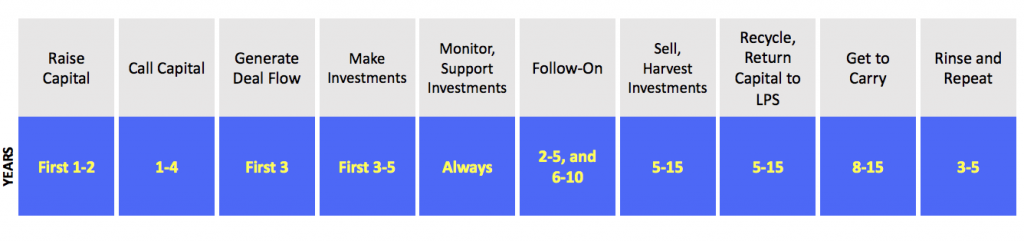

2% management fees: Charge the fee for managing salaries, rent, and utilities. Fees decrease after the end of a “commitment period,” usually three to five years before a firm can call capital from investors to make more investments.

20% carried interest or “carry”: Money of the profit that VC makes once they return capital to the limited partners. A VC must clear the 7-8% hurdle rate, which is the minimum rate a project must return, for the limited partners before the general partners join.

Fund example

Example: VC firm raises $100 million fund with 10 year lifetime

- Management fee: 2% x $100 million = $2 million per year

- Over 10 years: $2 million x 10 years = $20 million

The more money raised by a fund, the higher the management fees.

Example: Fund returns $2.1 billion (unlikely for most funds)

- Profit = $2.1 billion – ($100 million – original fund size) = $2 billion

- Limited partners get first returns from the $100 million fund

- General partner get 20% carry from the rest of the profits —> 20% x $2 billion = $200 million

Mechanics

Commitment period: Usually five years to identify and invest in new companies. Allocate reserves to each investment for “follow on” rounds. VC firms usually raise new funds every 3-5 years.

Investment period: The time a fund remains active, usually 10 years. Extensions are allowed but rare. If the management of investments goes beyond the investment period, funds can distribute private stock of portfolio companies to limited partners. The limited partners can pay more to keep the fund alive in case the companies deliver a multiple in returns. The managers of the VC firm can also sell the fund to a secondary market and close the fund itself.

Investment process

VC firms invest 3-4 out of 1,000 companies annually. That’s 0.2%. The average fundraising lasts six months.

- Sourcing: Find companies

- Evaluation: Screening

- Initial negotiation: Partner meeting with investment memo and thesis. Entrepreneurs present.

- Due diligence: Rigorous diligence.

- Final negotiation and decision: Terms are built and legal papers signed.

- Monitoring: The board helps with sales, marketing, recruiting, networking, and fundraising.

Types of VC firms

- Micro VC Funds. Less than $15 million. Invests at the seed and early stages with other angels and VC firms.

- Seed-Stage Funds. Up to $150 million. Provides a company the first non-company board member. First institutional capital into a company and rarely invests past series A.

- Early-Stage Funds. $100-300 million. Invests from seed to series B.

- Mid-Stage Funds. $200 million to $1 billion funds and invest in series B and later rounds. Called ”growth investors” and provide capital to grow and scale. Late-stage funds. Invests in successful stand-alone businesses on its last financing before an IPO.

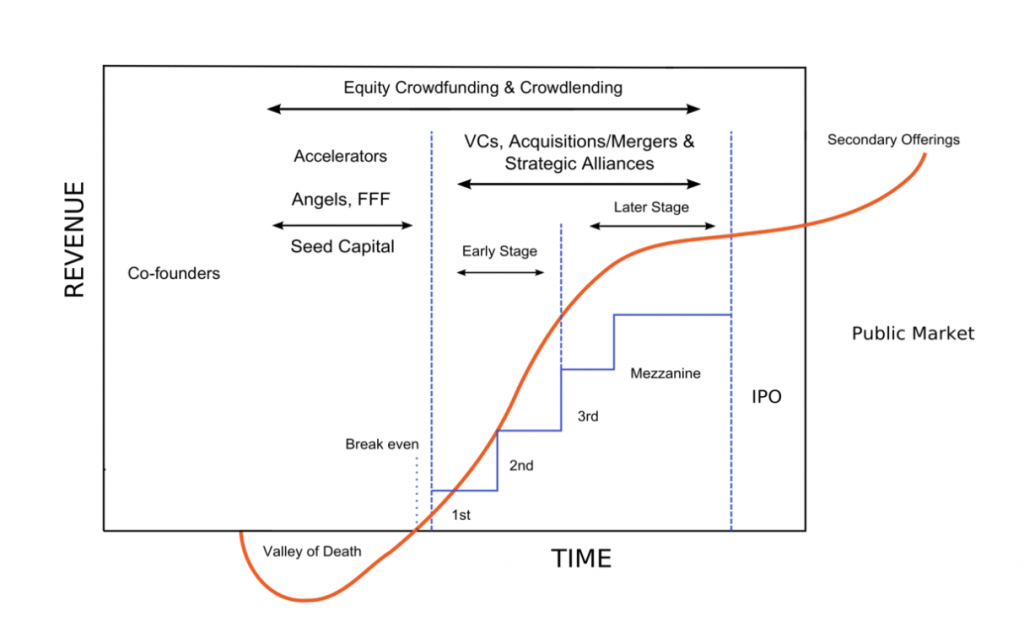

Stages of VC investment

Pre-seed → Seed → Seed A, B, C, D, etc.

Early-stage firms focus on founders and teams, product market risk, and owns more of the company. They invest small for large returns.

Mid-stage firms focus on team and product but look at traction and scale. They analyze sales and marketing, plus provide capital to grow.

Late-stage firms deal with exit risk and look at the market size. They can face potential acquisition and IPO. These firms include a mix of VCs, private equity firms, and public investors through mutual funds.

What VCs look for

VC firms want a team to get it done, a huge market with a brilliant product, a strong business model and proof that customers want to buy the product (traction), plus a strategy that shows a company can outlast competitors (differentiation). If you have a reasonable price per share (valuation), a VC is extra happy.

How entrepreneurs can get VCs to pay attention

Show how your company can return a 10x or more return to the fund. VCs only get a handful of successes out of 10, 20, or 50 investments, so they want to make sure that your deal can pay up for other losses.

Angel Investing

People who invest their own money in a startup. They love to help companies grow and invest money into a company expecting large returns (known as dilution). They are patient, nice, and risk tolerant. They’re known as financial and networking gurus.

Angel groups and syndicates

Angel investors pool more capital to make a big investment. They can also see more companies in their deal flow, which increases the chances of a successful startup. They share experiences from different fields, though one angel leader runs the group.

More VC words you should know

- Incubators: Multiple startups access the same office space or services. Founders benefit from being a startup ecosystem with other energetic people.

- Accelerators: Startup accelerators support early-stage companies through education, mentorship, and financing. Accelerators usually invest a small amount of $20,000 in exchange for a small amount of equity (6%) with additional follow-on available ($100,000). Startups enter accelerators for a short amount of time, usually three months, with other startups.

- CVC: A venture firm sponsored and backed by a corporation, often but not always part of a publicly traded company

- Crowdfunding: When a group of individuals funds a company either through equity purchase, debt purchase, pre-sale ordering of a product, or gifting of money like donations.

Content credits: An “Introduction to Venture Capital” PowerPoint by Avidan Rudansky, which was used in the Blueprint Investor Track.

Get more news and updates on Twitter and Medium. Want more DRF content or have suggestions? Subscribe to our newsletter or email our head of content at annewen@dormroomfund.com. Ready to take your startup to the next level? Apply here for an investment from Dorm Room Fund. Until next time! 🚀